What is PCI DSS Compliance? Top Requirements to adhere to get PCI DSS

What is PCI DSS?

The Payment Card Industry Data Security Standard (PCI DSS) was created in 2006 by Visa, MasterCard Discover Financial Services, JCB International, and American Express. The goal of this set of security standards overseen by the Payment Card Industry Security Standards Council (PCI SSC) is to protect credit and debit card transactions, from data theft and fraud. The PCI Security Standards Council is not a compliance organization. They do not require compliance, but individual payment networks may.

The main objective of PCI DSS is to safeguard cardholder information and prevent security breaches. This standard offers a structure that outlines the security prerequisites for organizations engaged in handling payment card details. It is necessary for any organization that handles credit/debit card data to adhere to the Payment Card Industry Data Security Standard (PCI DSS). This standard applies to entities involved in storing, processing, or transmitting credit card information.

Who needs to comply with PCI DSS?

PCI DSS applies to any organization that accepts, transmits, or stores cardholder data (CHD), regardless of size or transaction volume. This broad scope encompasses various entities involved in the payment card lifecycle, including:

- Merchants: Businesses that accept credit card payments from customers, such as online retailers, brick-and-mortar stores, and restaurants.

- Service providers: Third-party organizations that store, process, or transmit CHD on behalf of merchants, such as payment processors, data centers, and cloud providers.

- Payment processors: Entities that authorize and settle credit card transactions between merchants and issuing banks.

- Any other entity: Any organization that handles CHD during its transmission or storage, even if it’s not directly involved in the payment transaction.

Overview of PCI DSS Compliance

PCI DSS compliance consists of three major components:

- Handling the intake of credit card data from clients; specifically, ensuring that sensitive card information is gathered and delivered securely.

- Storing data securely, as defined in the PCI standard’s 12 security areas (discussed below), such as encryption, constant monitoring, and security testing of card data access.

- Annual validation of the needed security controls, which may involve forms, questionnaires, external vulnerability scanning services, and third-party audits.

PCI DSS primarily focuses on safeguarding sensitive CHD, which includes:

- Primary Account Number (PAN): The unique 16-digit number printed on the front of a credit card.

- Cardholder Name: The legal name of the cardholder associated with the PAN.

- Expiration Date: The month and year the card expires.

- Service Code: A three-digit code that identifies the card brand and network (e.g., Visa, MasterCard).

- Track Data: Magnetic stripe data encoded on the back of the card, containing the PAN, expiration date, and service code (considered especially sensitive due to its ease of duplication).

- Card Verification Value (CVV): A three- or four-digit security code used for additional verification during online transactions (not typically stored by merchants).

PCI DSS Certification

PCI DSS certification refers to the acknowledgment, from an entity that confirms an organization has successfully implemented the required security measures to adhere to the standard. Obtaining PCI DSS certification is not only an obligation for numerous businesses but also a way to showcase their dedication to safeguarding customer data and maintaining privacy.

Depending on the size and complexity of the company, the certification process entails a series of evaluations and audits undertaken by Qualified Security Assessors (QSAs) or internal security teams. These audits analyze the organization’s compliance with the PCI DSS criteria, verifying that suitable safeguards are in place to secure cardholder data.

PCI DSS Compliance Levels

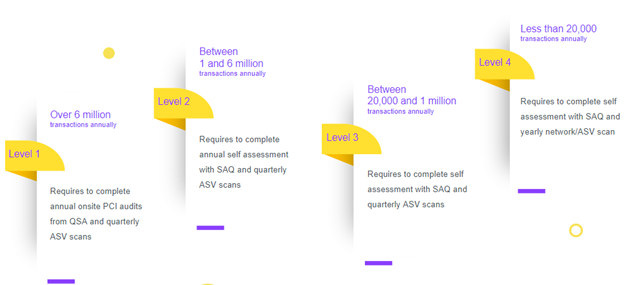

PCI DSS classifies organizations into different compliance levels based on their transaction volume. The classification helps tailor the security requirements to the specific risks associated with the volume of card transactions. The compliance levels are as follows:

- Level 1: This group includes merchants who conduct more than 6 million transactions each year. They must have an annual onsite assessment performed by a QSA, as well as submit an Attestation of Compliance (AOC) and a Quarterly Network Scan.

- Level 2: Applies to merchants who conduct one to six million credit or debit card transactions each year. They must perform an evaluation utilizing a Self-evaluation Questionnaire (SAQ) once a year. A quarterly PCI scan is also necessary.

- Level 3: This applies to merchants who perform 20,000 to one million e-commerce transactions every year. They must complete an annual evaluation using the appropriate SAQ. A quarterly PCI scan may be necessary as well.

- Level 4: Level 4 merchants execute fewer than 20,000 e-commerce transactions per year. They, like Level 3, must complete a yearly SAQ and conduct quarterly network scans.

Compliance levels are determined not just by transaction volume, but also by any history of security problems and the organization’s risk management approach.

12 Core PCI DSS Requirements

To achieve and maintain PCI DSS compliance, businesses must follow a set of 12 fundamental standards, each of which includes particular controls and best practices. These specifications are intended to address several areas of cardholder data security. Let’s take a look at each requirement:

- Build and maintain a secure network

- Install and maintain a firewall setup to secure cardholder data.

- System passwords must be original (not vendor-supplied)

- Protect Cardholder Data

- Safeguard stored cardholder data.

- Encrypt cardholder data transmission on open or public networks.

- Vulnerability management

- Use and regularly update anti-virus software or programs.

- Develop and maintain secure systems and applications.

- Implement strong access control measures

- Restrict access to cardholder data based on a need-to-know basis.

- Assign a unique ID to each person with computer access.

- Physical access to cardholder data must be restricted.

- Regularly monitor and test networks

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes.

- Maintain an Information Security Policy

- Maintain a policy that addresses information security for all personnel

Organizations must work together to meet these criteria, which include both technological and procedural controls. Regular assessments and audits are critical for maintaining compliance as well as detecting and mitigating any vulnerabilities.

Benefits of PCI DSS

- Customer trust and confidence

PCI DSS compliance displays a commitment to client data security and protection. Customers are more inclined to trust firms that follow these guidelines, resulting in a favorable reputation and client loyalty.

- Reduced risk of data breaches

Organizations implement solid security procedures that dramatically decrease the risk of data breaches by adhering to PCI DSS criteria. This not only safeguards the integrity of cardholder data but also protects the company from the legal and financial consequences of breaches.

- Legal and regulatory compliance

PCI DSS compliance frequently correlates with numerous legal and regulatory obligations. Meeting these criteria helps firms avoid legal penalties and regulatory costs for failing to effectively secure sensitive information.

- Improved Security Infrastructure

PCI DSS requires the deployment of strong security measures such as firewalls, encryption, access restrictions, and frequent security audits. This not only secures cardholder data but also improves the organization’s entire security architecture.

- Global market access

For firms to process payments in many foreign marketplaces, PCI DSS compliance is required. Compliance opens access to global markets, allowing firms to broaden their reach and engage in cross-border activities.

- Streamlined business operations

Adhering to PCI DSS requirements frequently necessitates the implementation of efficient and secure business procedures. This can result in more efficient operations, fewer vulnerabilities, and greater organizational efficiency.

- Partnership opportunities

Many business partners and stakeholders prefer to work with firms that place a high value on data protection. When pursuing partnerships or collaborations, PCI DSS compliance may be a differentiator by assuring other businesses that sensitive information is handled with care.

These benefits extend beyond mere compliance, contributing to the overall security posture and trustworthiness of businesses.

WeSecureApp Approach to PCI DSS Compliance Testing

Phase 1

Information Gathering, Scoping, and Gap Analysis

| 1. Project Planning and Kick-off Meeting

We’ll begin your PCI DSS compliance journey with a detailed project planning & kick-off meeting. During this session, we will define the project objectives, establish realistic timetables, and assign the resources needed to guarantee a smooth and effective compliance process. |

2. High-level organizational understanding

Our team will collaborate closely with yours to get a complete grasp of the structure, procedures, and systems of your firm. |

3. Scope definition of PCI DSS

We’ll work together to define the systems, procedures, and persons involved in the processing of cardholder data. For a focused and successful strategy, the compliance scope must be aligned with your company’s activities. |

4. Assess control gaps

Our specialists will conduct a complete assessment of control gaps by PCI-DSS’s 12 standards. This evaluation will highlight areas where your current controls may need to be improved or modified, allowing us to prioritize remedial activities. |

Phase 2

Security Assessment

| 1. Perform risk assessment

A thorough risk assessment will be carried out in order to identify possible threats and weaknesses. We will prioritize risks based on their effect and likelihood of recurrence during this process, allowing us to focus on the most crucial areas. |

2. Vulnerability Assessment and Penetration Testing

Within the stated scope, our team will conduct Vulnerability Assessments and Penetration Testing on your infrastructure and apps. This stage is critical for detecting and correcting vulnerabilities while also strengthening your organization’s overall security posture. |

3. LAN segmentation testing

To prevent unauthorized access to critical locations, LAN segmentation must be validated. We’ll make sure your network segmentation complies with PCI DSS rules for properly segregating cardholder data. |

4. Conduct Firewall rule set review

Our specialists will conduct a thorough analysis of your firewall rule sets to ensure compliance with PCI DSS regulations. Any misconfigurations or vulnerabilities discovered in the firewall infrastructure will be fixed as soon as possible. |

Phase 3

Remediation of Risks and Implementation of Controls

| 1. Consultation for implementation

We’ll collaborate to implement the required controls identified during the Gap Analysis and Risk Assessment phase. Our guidance will ensure the effective implementation of security controls tailored to your organization. |

2. PCI-DSS awareness training

All relevant personnel will get comprehensive PCI-DSS Awareness Training. This training will highlight the significance of compliance while also clarifying each individual’s responsibilities. |

3. Modify or create policies

We will evaluate, change, or develop policies as needed to ensure compliance with PCI-DSS. To maintain compliance and seamless operations, clear rules for data security, access restrictions, and incident response will be defined. |

Phase 4

Certification Support

| 1. Help the client find the right QSA

We will help you find a Qualified Security Assessor (QSA) with industry experience. It is critical to select a QSA that understands your environment and has the essential skills to adequately assess controls. |

2. Conduct Pre-Audit validation

We will perform a pre-audit before the formal certification exam to ensure that all PCI DSS criteria are fully fulfilled. To guarantee a successful certification procedure, any remaining gaps will be discovered and remedied. |

WeSecureApp Approach in Action

The WeSecureApp Approach is intended to lead you through a deliberate and planned approach toward PCI DSS compliance. We seek to assist you in achieving compliance while also strengthening your entire security posture by combining diligent planning, thorough assessments, and proactive remedial activities. Our devotion to continuous development guarantees that compliance is not a one-time event, but rather an ongoing commitment to protecting your sensitive cardholder data.

Recommended Reading

Penetration Testing Across Industries: Requirements and Assessment Scope

Penetration Testing for Sensitive Data Exposure in Enterprise Networks

Penetration Testing for Server-Side Request Forgery (SSRF) in E-commerce Platforms

The post What is PCI DSS Compliance? Top Requirements to adhere to get PCI DSS appeared first on WeSecureApp :: Simplifying Enterprise Security.

*** This is a Security Bloggers Network syndicated blog from WeSecureApp :: Simplifying Enterprise Security authored by Vishaka Sethia. Read the original post at: https://wesecureapp.com/blog/what-is-pci-dss-compliance-top-requirements-to-adhere-to-get-pci-dss/