Cryptocurrency is starting to feel like the 1637 Dutch tulip market

Wagon of Fools by Hendrik Gerritsz Pot, 1637

Bitcoin and the 17th-century Dutch tulip market are starting to have more in common than one would think. The story begins in 17th century Holland when the demand for tulips, fueled by a jump in agritech, drove the price of bulbs up. Speculators piled on, starting a frenzy of borrowing, buying, markup selling, buying more, and placing bets on a tulip futures market. Some people got rich and didn’t think the good times would end… until it did.

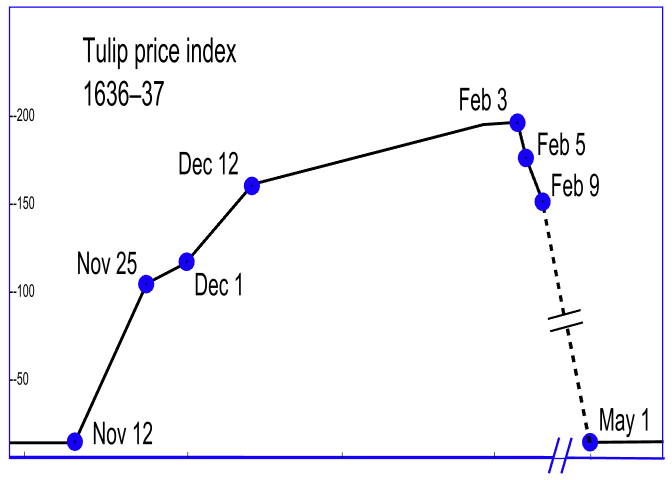

Tulip Mania is thought to be one of the first speculative bubbles and subsequent crashes in history. Today, Tulip Mania is an allegory for situations where large groups of investors irrationally put their money in speculative investments and drive the price up, causing more people to pile in – until the inevitable crash.

I’ve always been somewhat bearish on Bitcoin and other cryptocurrencies, but I’ve kept my mind open to see if this would turn into an alternate form of currency. Lately, I’ve concluded that it is not a form of currency but rather a speculative asset that had more in common with the 17th-century Dutch tulip market than the US dollar or gold.

Why?

Listen to the risk managers.

What do the risk managers say?

Whenever I want a deeper understanding of threats, risks, and how those change over time, I go straight to the risk managers. Coinbase, a digital and cryptocurrency exchange platform, filed their Form S-1 with the Security and Exchange Commission last week in preparation for an IPO, and, well – it’s an eye-opener.

S-1’s, 10-K’s, and others are reports filed by current or aspiring public companies about the state of their business. There’s always a risk section in which company leadership describes any threats to the company. Some of the risks are the usual suspects one would see in a financial services firm. There are a few, however… yeah. Dutch Tulip Mania.

Coinbase Risks

All SEC filings have the usual risks, like the threat of new entrants, cyber-attacks, etc. Coinbase has some interesting and unique risks, however, that apply to both their platform and cryptocurrency in general. The disclosed risks – and the entire S-1 – warrants a thorough readthrough if you have any interest in or are currently invested in cryptocurrency.

Coinbase has listed the following risks that could adversely affect cryptocurrency or the company:

“…disruptions, hacks, splits in the underlying network also known as “forks”, attacks by malicious actors who control a significant portion of the networks’ hash rate such as double spend or 51% attacks, or other similar incidents affecting the Bitcoin or Ethereum blockchain networks.” (Page 19)

Bitcoin and other cryptocurrencies are distributed networks and peer-to-peer. To maintain the integrity of the blockchain, 51% of the nodes have to “agree” on transactions. The 51% agreement is a defense against attacks. Compromising the integrity of the blockchain has occurred on other cryptocurrencies, and I think it’s just a matter of time before it happens on Bitcoin. Yes, it will take enormous computing power, but resourced and motivated adversaries, such as a country or large criminal enterprise, could muster enough computing power to pull this off. Countries have sought to destabilize the economies of their adversaries through currency manipulation many times in the past, and a 51% attack is entirely within the realm of possibility if people, governments, or economies start to rely on Bitcoin.

“…the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed Bitcoin, or the transfer of Satoshi’s Bitcoins.” (page 19)

Wait, what? Why? Why would the revelation of the identity of Satoshi Nakamoto cause risk to Coinbase or Bitcoin? What does he know? What does Coinbase know about what he knows? Obviously, it’s enough to disclose it to the SEC. There’s speculation, which is insane when considering that people rely on this as money, but what else is there?

The second risk is a no-brainer: if Satoshi has 1.1 million Bitcoin out of an eventual pool of 21 million, he could destabilize the market if he managed to pull it out suddenly.

“…development in mathematics, technology, including in digital computing, algebraic geometry, and quantum computing that could result in the cryptography being used by Bitcoin and Ethereum becoming insecure or ineffective” (page 19)

I listed this as a top-of-mind risk in my last blog post, and it’s a big one. This would negatively affect cryptocurrency, all levels of computer security, e-commerce, and communications as we know it. I give this a 60% probability of occurring in the next 30 years, although I don’t know what the cause is going to be. It could be one of the above events or something else entirely.

“..there have been reports that a significant amount of crypto asset trading volume on crypto asset platforms is fabricated and false in nature, with a specific focus on unregulated platforms located outside the United States. Such reports may indicate that the market for crypto asset platform activities is significantly smaller than otherwise understood.” (page 44)

Left without comment.

Final Thoughts

Dutch Tulip Price Index (by JayHenry | CC BY-SA 3.0)

March 2021 looks too much like February 1637 to me. I’m obviously in the minority position because of the number of people piling into Bitcoin now, but I just don’t think the prices are supported by anything rational behind it. History is filled with stories of people that try to get ahead by outsmarting the market. Unfortunately, we mostly hear about the successes, not the failures – aka, survivorship bias.

When there is any level of decision-making under uncertainty to be made, I always ask, what do the risk managers say? In this case, Coinbase’s risk managers prompted an unintended consequence – it scared me away from investing in cryptocurrency altogether.

*** This is a Security Bloggers Network syndicated blog from Blog - Tony Martin-Vegue authored by Tony MartinVegue. Read the original post at: https://www.tonym-v.com/blog/2021/3/8/cryptocurrency-is-starting-to-feel-like-the-1637-dutch-tulip-market