Implementing a Cybersecurity Strategy in the Banking Sector

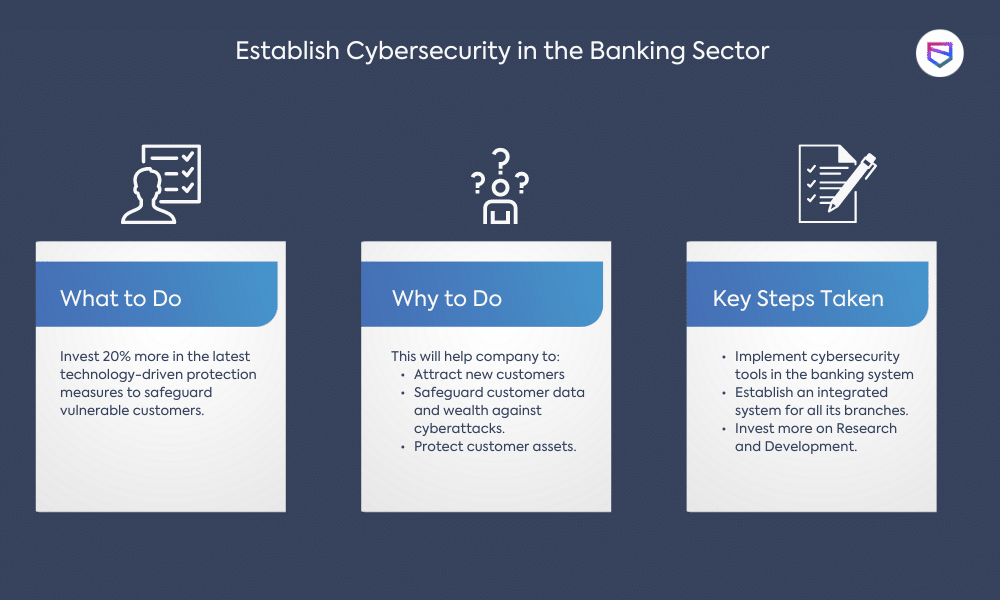

A cybersecurity strategy in the banking sector should focus on protecting the confidentiality, integrity, and availability of sensitive financial information and systems. This can be achieved through a combination of technical, organizational, and legal measures. Some key elements of a cybersecurity strategy in the banking sector might include the following:

-

Risk assessment and management:

In the banking sector, risk assessment and management involve identifying, analyzing, and mitigating potential risks that could have an impact on the bank’s operations, financial performance, and reputation. Some common risks faced by banks include credit risk, market risk, liquidity risk, operational risk, and compliance risk.

To manage these risks, banks typically use a variety of tools and techniques, including:

- Risk assessment: This involves identifying potential risks and evaluating their likelihood and potential impact. Banks may use various methods to assess risk, including scenario analysis, stress testing, and risk modeling.

- Risk controls: Once risks have been identified, banks can implement controls to mitigate or eliminate them. These may include internal policies and procedures, risk management software, and changes to business processes.

- Risk reporting: Banks often have systems in place to monitor and report on risk levels, allowing them to make informed decisions about risk management strategies.

- Risk diversification: One way to manage risk is to diversify a bank’s portfolio so that it is not overly exposed to any one type of risk. This can be achieved through investment in a variety of asset classes or by providing a range of financial products and services.

Overall, effective risk assessment and management are essential for the stability and success of any bank.

-

Network and system security:

In the banking sector, network and system security are of critical importance, as banks handle large amounts of sensitive financial data and are often targeted by cybercriminals. To protect their networks and systems, banks use a variety of security measures, including:

- Firewalls: These are used to block unauthorized access to a network and can be configured to allow or block specific types of traffic.

- Encryption: Encrypting data makes it unreadable to anyone without the appropriate decryption key, protecting it from interception or unauthorized access.

- Access controls: Banks may use measures such as passwords, two-factor authentication, and biometric authentication to control access to their networks and systems.

- Intrusion detection and prevention: These systems monitor network activity for signs of attempted attacks and can take automated action to prevent them.

By implementing these and other security measures, banks can protect their networks and systems and help ensure the confidentiality, integrity, and availability of their sensitive data.

-

Data protection:

Data protection is a key concern in the banking sector, as banks handle large amounts of sensitive personal and financial information. Implement controls to protect sensitive data, including encryption, access controls, and regular backups.

-

Employee education and training:

Ensure that employees are aware of the importance of cybersecurity and are trained to recognize and prevent potential threats.

-

Incident response plan:

An incident response plan is a set of procedures and guidelines that a bank follows in the event of a security incident or breach. The goal of an incident response plan is to minimize the impact of the incident and restore normal operations as quickly as possible. Develop a plan to respond to and recover from cyber incidents, including procedures for reporting incidents, conducting investigations, and communicating with stakeholders.

-

Compliance:

Ensure that the organization is compliant with relevant cybersecurity regulations and standards, such as the Payment Card Industry Data Security Standard (PCI DSS) for organizations that handle credit card transactions.

Compliance refers to the act of adhering to laws, regulations, and guidelines that apply to a particular industry or sector. In the banking sector, compliance is of critical importance, as banks are subject to a wide range of laws and regulations that aim to ensure the stability and integrity of the financial system.

Some key areas of compliance in the banking sector include:

- Anti-money laundering (AML): Banks are required to implement measures to prevent, detect, and report money laundering activities.

- Consumer protection: Banks are subject to various laws and regulations designed to protect the rights and interests of consumers, such as the Consumer Financial Protection Act in the United States.

- Data protection: Banks are required to implement measures to protect the confidentiality, integrity, and availability of customer data, and to comply with laws such as the General Data Protection Regulation (GDPR) in the European Union.

- Financial reporting: Banks are required to report their financial performance and position accurately and transparently, in compliance with accounting standards and regulatory requirements.

- Cybersecurity: Banks are expected to implement appropriate cybersecurity measures to protect their systems and data from cyber threats.

Overall, compliance is essential for the stability and integrity of the banking sector, and banks are expected to have robust compliance programs in place to ensure they are meeting their regulatory obligations.

-

Third-party vendor management:

Conduct thorough due diligence on third-party vendors and implement controls to ensure that they meet the organization’s cybersecurity standards.

Conclusion:

Implementing these measures can help to protect the organization’s sensitive financial information and systems, as well as maintain the trust of customers and other stakeholders. A comprehensive cybersecurity strategy is essential for protecting against cyber threats in the banking sector. This includes conducting regular risk assessments, developing and implementing clear policies and procedures, providing security awareness training to employees, securing networks and systems, protecting customer data, and having a plan in place for responding to cyber incidents. By taking these steps, banks can ensure that they are well-prepared to protect against cyber threats and keep their customers’ sensitive data safe.

Recommended Reading:

Top 5 Cybersecurity Trends to Keep an Eye on in 2023

Is Dark Web Monitoring Vital? How does it work?

How To Implement Assume-Breach Security?

The post Implementing a Cybersecurity Strategy in the Banking Sector appeared first on WeSecureApp :: Simplifying Enterprise Security.

*** This is a Security Bloggers Network syndicated blog from WeSecureApp :: Simplifying Enterprise Security authored by Naimisha. Read the original post at: https://wesecureapp.com/blog/implementing-a-cybersecurity-strategy-in-the-banking-sector/