Weekly Cyber Risk Roundup: Cryptocurrency Attacks and a Major Cybercriminal Indictment

Cryptocurrency continued to make headlines this past week for a variety of cybercrime-related activities.

For starters, researchers discovered a new cryptocurrency miner, dubbed ADB.Miner, that infected nearly 7,000 Android devices such as smartphones, televisions, and tablets over a several-day period. The researchers said the malware uses the ADB debug interface on port 5555 to spread and that it has Mirai code within its scanning module.

For starters, researchers discovered a new cryptocurrency miner, dubbed ADB.Miner, that infected nearly 7,000 Android devices such as smartphones, televisions, and tablets over a several-day period. The researchers said the malware uses the ADB debug interface on port 5555 to spread and that it has Mirai code within its scanning module.

In addition, several organizations reported malware infections involving cryptocurrency miners. Four servers at a wastewater facility in Europe were infected with malware designed to mine Monero, and the incident is the first ever documented mining attack to hit an operational technology network of a critical infrastructure operator, security firm Radiflow said. In addition, Decatur County General Hospital recently reported that cryptocurrency mining malware was found on a server related to its electronic medical record system.

Reuters also reported this week on allegations by South Korea that North Korea had hacked into unnamed cryptocurrency exchanges and stolen billions of won. Investors of the Bee Token ICO were also duped after scammers sent out phishing messages to the token’s mailing list claiming that a surprise partnership with Microsoft had been formed and that those who contributed to the ICO in the next six hours would receive a 100% bonus.

All of the recent cryptocurrency-related cybercrime headlines have led some experts to speculate that the use of mining software on unsuspecting users’ machines, or cryptojacking, may eventually surpass ransomware as the primary money maker for cybercriminals.

Other trending cybercrime events from the week include:

- W-2 data compromised: The City of Pittsburg said that some employees had their W-2 information compromised due to a phishing attack. The University of Northern Colorado said that 12 employees had their information compromised due to unauthorized access to their profiles on the university’s online portal, Ursa, which led to the theft of W-2 information. Washington school districts are warning that an ongoing phishing campaign is targeting human resources and payroll staff in an attempt to compromise W-2 information.

- U.S. defense secrets targeted: The Russian hacking group known as Fancy Bear successfully gained access to the email accounts of contract workers related to sensitive U.S. defense technology; however, it is uncertain what may have been stolen. The Associated Press reported that the group targeted at least 87 people working on militarized drones, missiles, rockets, stealth fighter jets, cloud-computing platforms, or other sensitive activities, and as many as 40 percent of those targeted ultimately clicked on the hackers’ phishing links.

- Financial information stolen: Advance-Online is notifying customers that their personal and financial information stored on the company’s online platform may have been subject to unauthorized access from April 29, 2017 to January 12, 2018. Citizens Financials Group is notifying customers that their financial information may have been compromised due to the discovery of a skimming device found at a Citizens Bank ATM in Connecticut. Ameriprise Financial is notifying customers that one of its former employees has been calling its service center and impersonating them by using their name, address, and account numbers.

- Other notable events: Swisscom said that the “misappropriation of a sales partner’s access rights” led to a 2017 data breach that affected approximately 800,000 customers. A cloud repository belonging to the Paris-based brand marketing company Octoly was erroneously configured for public access and exposed the personal information of more than 12,000 Instagram, Twitter, and YouTube personalities. Ron’s Pharmacy in Oregon is notifying customers that their personal information may have been compromised due to unauthorized access to an employee’s email account. Partners Healthcare said that a May 2017 data breach may have exposed the personal information of up to 2,600 patients. Harvey County in Kansas said that a cyber-attack disrupted county services and led to a portion of the network being disabled. Smith Dental in Tennessee said that a ransomware infection may have compromised the personal information of 1,500 patients. Fresenius Medical Care North America has agreed to a $3.5 million settlement to settle potential HIPAA violations stemming from five separate breaches that occurred in 2012.

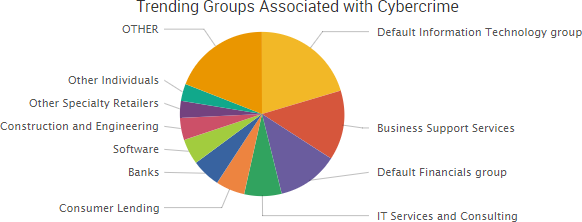

SurfWatch Labs collected data on many different companies tied to cybercrime over the past week. Some of those “newly seen” targets, meaning they either appeared in SurfWatch Labs’ data for the first time or else reappeared after being absent for several weeks, are shown in the chart below.

Cyber Risk Trends From the Past Week

A federal indictment charging 36 individuals for their role in a cybercriminal enterprise known as the Infraud Organization, which was responsible for more than $530 million in losses, was unsealed this past week. Acting Assistant Attorney General Cronan said the case is “one of the largest cyberfraud enterprise prosecutions ever undertaken by the Department of Justice.”

A federal indictment charging 36 individuals for their role in a cybercriminal enterprise known as the Infraud Organization, which was responsible for more than $530 million in losses, was unsealed this past week. Acting Assistant Attorney General Cronan said the case is “one of the largest cyberfraud enterprise prosecutions ever undertaken by the Department of Justice.”

The indictment alleges that the group engaged in the large-scale acquisition, sale, and dissemination of stolen identities, compromised debit and credit cards, personally identifiable information, financial and banking information, computer malware, and other contraband dating back to October 2010. Thirteen of those charged were taken into custody in countries around the world.

As the Justice Department press release noted:

Under the slogan, “In Fraud We Trust,” the organization directed traffic and potential purchasers to the automated vending sites of its members, which served as online conduits to traffic in stolen means of identification, stolen financial and banking information, malware, and other illicit goods. It also provided an escrow service to facilitate illicit digital currency transactions among its members and employed screening protocols that purported to ensure only high quality vendors of stolen cards, personally identifiable information, and other contraband were permitted to advertise to members.

ABC News reported that investigators believe the group’s nearly 11,000 members targeted more than 4.3 million credit cards, debit cards, and bank accounts worldwide. Over its seven-year history, the group inflicted $2.2 billion in intended losses and more than $530 million in actual losses against a wide range of financial institutions, merchants, and individuals.

*** This is a Security Bloggers Network syndicated blog from SurfWatch Labs, Inc. authored by Jeff Peters. Read the original post at: https://blog.surfwatchlabs.com/2018/02/11/weekly-cyber-risk-roundup-cryptocurrency-attacks-and-a-major-cybercriminal-indictment/